The Ins and Outs of Automobile Leasing: A Comprehensive Guide on Exactly How It Functions

Navigating the world of automobile leasing can be a complicated venture, calling for a firm understanding of the ins and outs involved. From comprehending lease terms to computing payments and checking out end-of-lease options, there are many aspects to take into consideration when pondering this financial commitment. As consumers progressively choose leasing over typical vehicle ownership, it becomes necessary to unravel the nuances of this process to make educated choices. In this thorough guide, we will certainly study the core components of vehicle leasing, shedding light on the systems that drive this prominent automobile acquisition approach.

Advantages of Cars And Truck Leasing

One significant advantage is the lower regular monthly settlements linked with leasing compared to purchasing a car. Leasing enables individuals to drive a more recent automobile with reduced ahead of time costs and reduced regular monthly settlements given that they are only funding the lorry's depreciation during the lease term, instead than the whole acquisition price.

Furthermore, cars and truck leasing often comes with service warranty coverage for the duration of the lease, providing assurance against unforeseen repair work expenses. Given that rented vehicles are typically under the manufacturer's guarantee during the lease term, lessees can prevent the monetary worry of major repairs. Leasing may provide tax obligation advantages for service owners who make use of the vehicle for business objectives, as lease settlements can commonly be deducted as a company expense. In general, the financial advantages of auto leasing make it an engaging option for several consumers.

Comprehending Lease Terms

Considering the monetary benefits of auto leasing, it is necessary to understand the details of lease terms to make educated choices regarding this car funding option. Lease terms describe the certain problems detailed in the leasing agreement between the lessee (the person renting the automobile) and the owner (the leasing firm) These terms usually consist of the lease duration, regular monthly settlement quantity, gas mileage limitations, damage standards, and any kind of potential charges or fines.

Computing Lease Repayments

Discovering the procedure of calculating lease settlements loses light on vital monetary considerations for people involving in automobile leasing agreements. Lease payments are typically determined by considering factors such as the vehicle's devaluation, the agreed-upon lease term, the cash aspect (interest price), and any type of additional charges. To determine lease payments, one can use the adhering to formula: Month-to-month Lease Repayment = (Depreciation + Finance Fee) ÷ Number of Months in the Lease Term.

Maintenance and Insurance Considerations

Recognizing the maintenance and insurance needs connected with automobile leasing is essential for lessees to make sure the proper treatment and defense of the automobile throughout the lease term. Maintenance duties vary amongst leasing arrangements, but lessees are normally expected to i thought about this support the producer's advised maintenance timetable. Failing to do so might result in fines at the end of the lease or void certain service warranties. When necessary., lessees must maintain detailed documents of all upkeep and repairs to supply evidence of compliance.

Regarding insurance coverage, all rented lorries have to have thorough and crash insurance coverage with responsibility limits that meet or go beyond the leasing company's demands. This is to secure both the lessee and the renting firm in case of an accident or damage to the car. It's crucial to meticulously review the insurance requirements described in the lease contract and make sure that the coverage is preserved throughout the lease term. Failure to maintain ample insurance policy protection can result in major repercussions, including prospective monetary liabilities and legal issues. By fulfilling these upkeep and recognizing and insurance policy commitments, lessees can take pleasure in a smooth leasing experience while securing the leased car.

End-of-Lease Options and Process

As completion of the lease term strategies, lessees are provided with various options and a specified procedure for choosing or returning the car to pursue a different setup. One typical option is to merely return the lorry to the see here now lessor at the end of the lease term. Lessees are usually in charge of any kind of excess gas mileage costs, deterioration costs, and any type of other impressive settlements as outlined in the lease contract.

One more choice for lessees is to sell the rented automobile for a brand-new lease or acquisition. This can be a practical option for those that prefer to continually drive a new automobile without the hassle of selling or returning the current rented lorry.

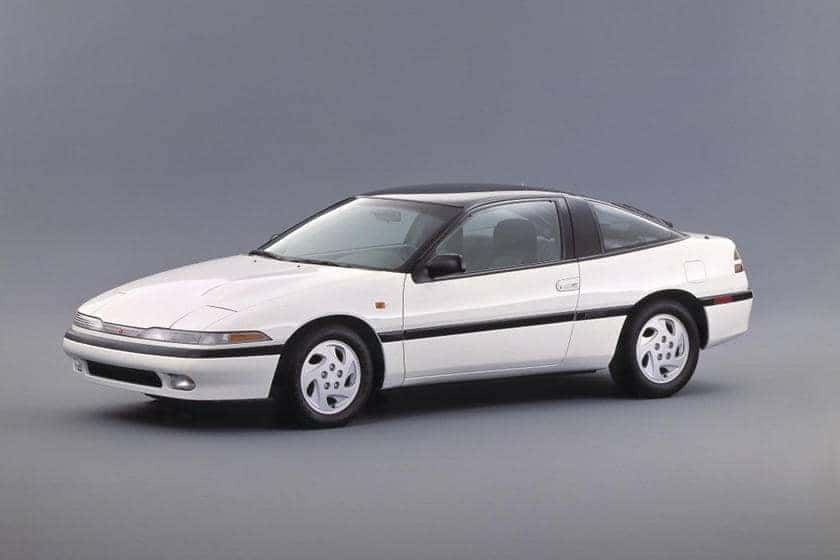

Eventually, comprehending the end-of-lease alternatives and procedure is critical for lessees to make informed choices that align with their requirements and preferences. Mitsubishi Mirage lease offers Southington.

Conclusion

Understanding lease terms, computing payments, and taking into consideration upkeep and insurance are critical elements of the leasing procedure. Furthermore, understanding the end-of-lease choices and process is important for a smooth change at the end of the lease term.

Because rented cars are typically under the maker's warranty throughout the lease term, lessees can avoid the financial burden of major repair work. Lease terms refer to the particular problems described in the leasing arrangement between the lessee (the individual renting the auto) and the owner (the renting business)One crucial facet of lease terms is the lease duration, which is the length of time the lessee concurs to rent the car. Affordable lease offers pop over to these guys Wethersfield. Lease repayments are commonly established by thinking about elements such as the lorry's depreciation, the agreed-upon lease term, the cash factor (rate of interest price), and any extra fees. To calculate lease payments, one can use the complying with formula: Month-to-month Lease Settlement = (Depreciation + Finance Fee) ÷ Number of Months in the Lease Term